Introduction:

A public company is a type of corporation that has issued securities, such as stocks or bonds, through an initial public offering (IPO) and is listed and traded on a public stock exchange. Public companies have a large number of shareholders and are subject to regulatory requirements, including financial reporting and disclosure, enforced by government agencies such as the Securities and Exchange Commission (SEC) in the United States.

On the other hand, a private company is a corporation that is owned by a relatively small number of shareholders and does not offer its securities for sale to the general public. Private companies do not trade on public stock exchanges and are not subject to the same level of regulatory scrutiny as public companies. They have more flexibility in their operations and are not required to disclose financial information to the public.

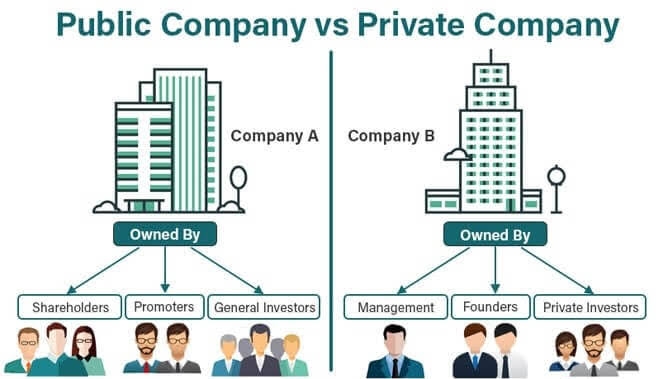

The main differences between public and private companies lie in their ownership structure, regulatory requirements, access to capital markets, and level of transparency:

- Ownership Structure:

- Public companies are owned by shareholders who can buy and sell shares freely on the stock market.

- Private companies are typically owned by a smaller group of shareholders, founders, or investors, and shares are not traded publicly.

- Regulatory Requirements:

- Public companies are subject to strict regulatory requirements imposed by government agencies, such as the Securities and Exchange Commission (SEC) in the United States. These requirements include financial reporting, disclosure of information, and compliance with securities laws.

- Private companies have fewer regulatory obligations compared to public companies. They are not required to disclose financial information to the public and have more flexibility in their operations.

- Access to Capital Markets:

- Public companies can raise capital by selling shares to the public through initial public offerings (IPOs) and subsequent equity offerings.

- Private companies raise capital through private investments from venture capitalists, angel investors, or private equity firms. They do not have access to the public capital markets.

- Transparency:

- Public companies are required to disclose extensive financial and operational information to shareholders, regulators, and the public. This includes quarterly and annual financial statements, as well as other disclosures required by regulatory agencies.

- Private companies have more privacy regarding their financial and operational information. They are not obligated to disclose information to the public, which allows them to maintain confidentiality about their business strategies and financial performance.

Overall, while both public and private companies serve as vehicles for business operations and growth, they operate under different regulatory frameworks and have distinct characteristics in terms of ownership, access to capital, and transparency.